RTX Announces Historic Production Expansion Under Pentagon Framework Agreements

Raytheon, an RTX business, entered into five landmark framework agreements with the U.S. Department of War to significantly increase production capacity and speed deliveries of critical precision munitions, the company announced February 4, 2026.

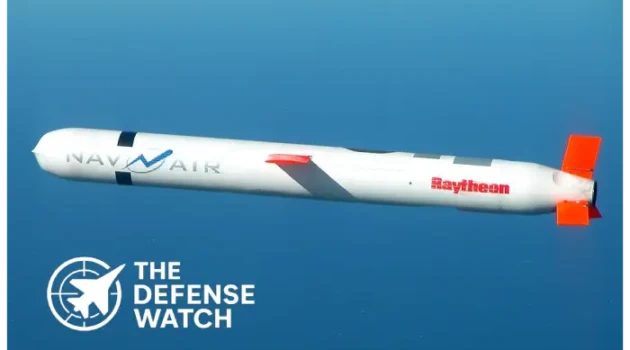

The defense contractor will substantially expand manufacturing of Land Attack and Maritime Strike variants of Tomahawk cruise missiles, AMRAAM air-to-air missiles, and multiple Standard Missile interceptor variants under agreements spanning up to seven years. RTX will increase annual production of Tomahawks to more than 1,000, AMRAAMs to at least 1,900, and SM-6 to more than 500, representing two-to-four-fold increases over current production rates for several munitions.

The agreements cover production of five weapon systems: Tomahawk cruise missiles, AMRAAM missiles, Standard Missile-3 Block IB interceptors, Standard Missile-3 Block IIA interceptors, and Standard Missile-6 missiles. Production will occur at Raytheon facilities in Tucson, Arizona; Huntsville, Alabama; and Andover, Massachusetts.

Strategic Significance of Production Expansion

The framework agreements represent a significant shift in defense-industrial collaboration, according to company leadership. RTX CEO and Chairman Chris Calio stated the deals “redefine how government and industry can partner to speed the delivery of critical technologies” and align with the administration’s Acquisition Transformation Strategy.

The expansion addresses sustained growth in global demand for precision munitions as U.S. forces and allied militaries increase stockpile requirements. The Tomahawk missile system has been flight-tested over 550 times and used operationally more than 2,300 times since its introduction, establishing itself as a primary long-range strike option for U.S. naval forces.

AMRAAM missiles serve as the principal air-to-air weapon for U.S. fighter aircraft and have been deployed by more than 40 allied nations. The Standard Missile family provides layered air and missile defense capabilities for naval vessels and ground-based systems, with the SM-3 variants specifically designed for ballistic missile intercept missions.

Production Facilities and Investment Strategy

Manufacturing under the new agreements will leverage existing Raytheon infrastructure while incorporating significant facility upgrades and workforce expansion. The company has committed to continued investment in production capacity and acceleration projects beyond previous expenditure levels.

The long-term agreements incorporate a collaborative funding approach designed to preserve upfront free cash flow, allowing RTX to invest confidently to meet long-term demand, according to the company statement. The financial commitments associated with these frameworks have been incorporated into RTX’s 2026 financial outlook, which projects capital expenditures exceeding $3 billion.

The Tucson facility will serve as the primary production site for several missile variants, while Huntsville operations will support advanced interceptor manufacturing. The Andover location will contribute to component production and integration activities across multiple programs.

Weapon System Capabilities and Performance

The Tomahawk cruise missile provides precision strike capability from standoff ranges exceeding 1,000 miles, enabling attacks against heavily defended targets while keeping launch platforms outside enemy engagement zones. Both land-attack and maritime strike variants will see production increases under the new agreements.

AMRAAM missiles provide beyond-visual-range air-to-air engagement capability with active radar guidance and all-weather performance. The weapon serves as the primary air-to-air armament for F-15, F-16, F-18, and F-22 fighter aircraft across U.S. and allied air forces.

The Standard Missile-3 Block IB and Block IIA variants provide exoatmospheric intercept capability against short-to-intermediate-range ballistic missiles. The SM-3 IIA, developed in partnership with Japan, extends intercept range and altitude compared to earlier variants. Standard Missile-6 provides multi-mission capability including anti-air warfare, ballistic missile defense, and anti-surface warfare from a single weapon system.

Defense Industrial Base Implications

The production expansion represents a significant commitment to strengthening U.S. defense manufacturing infrastructure. The agreements formalize long-term production commitments that enable contractors to make facility and workforce investments with greater financial certainty.

Industry observers note the framework approach provides stability for supply chain partners and enables more efficient procurement of long-lead materials and components. The seven-year agreement duration allows for phased capacity expansion rather than rapid scaling that can strain quality control and supplier relationships.

The increased production rates will require workforce expansion across multiple facilities and skill sets, from precision machining and electronics assembly to quality assurance and systems integration. RTX has indicated the agreements support the Department of War’s objectives for industrial base strengthening and American job creation.

Strategic Context and Global Demand

The munition production expansion occurs amid heightened global tensions and increased defense spending among U.S. allies. Multiple allied nations have requested increased deliveries of American-made precision weapons to modernize their forces and replenish stocks.

Recent conflicts have demonstrated the high consumption rates of precision munitions in modern combat operations. U.S. forces and coalition partners have utilized Tomahawk cruise missiles, AMRAAM air-to-air weapons, and Standard Missile interceptors extensively in recent operations, driving requirements for expanded production capacity.

The Standard Missile family has seen particular demand growth as allied navies invest in ballistic missile defense capabilities. Japan, Australia, and several European nations operate or have ordered destroyers and frigates equipped with Aegis combat systems that utilize Standard Missile interceptors.

Naval forces globally have increased requirements for Tomahawk missiles as more platforms gain launch capability. The weapon has been integrated with Virginia-class submarines, Zumwalt-class destroyers, and multiple cruiser and destroyer classes. Allied nations including the United Kingdom and Australia have procured Tomahawk systems for their naval forces.

Program Timeline and Production Ramp

RTX has not disclosed specific timelines for reaching peak production rates under the new agreements, though the company indicated manufacturing will begin in accordance with existing facility capabilities and planned expansion activities. The seven-year framework duration suggests a multi-year ramp to full production capacity.

Industry analysts note that missile production scaling requires careful coordination of complex supply chains involving hundreds of components and subassemblies. Critical long-lead items such as rocket motors, guidance systems, and specialized electronics require their own capacity expansion to support higher production rates.

The company’s 2026 capital expenditure budget includes funding for production line expansions, equipment procurement, and facility modifications necessary to achieve target production rates. Additional workforce hiring and training will occur as production lines scale toward full capacity.

Financial and Market Impact

RTX stock has performed strongly in recent months, with shares trading near 52-week highs. The company reported fourth-quarter revenue of $24.24 billion, exceeding analyst estimates, with earnings per share of $1.55 beating consensus forecasts of $1.47.

The defense contractor maintains a diversified business portfolio spanning commercial and military aviation, missile systems, and aerospace components through its Pratt & Whitney, Collins Aerospace, and Raytheon divisions. Defense systems account for approximately 33% of total company revenue.

Analyst firms have maintained generally positive ratings on RTX shares following the munition production announcement, with price targets ranging from recent lows around $168 to highs approaching $227. The long-term framework agreements provide revenue visibility and support projections for sustained defense systems growth.

Conclusion

The five framework agreements between RTX’s Raytheon division and the U.S. Department of War represent one of the most significant defense production expansions in recent years. The commitment to more than double production of critical precision munitions addresses urgent requirements from U.S. forces and allied militaries while strengthening American defense manufacturing infrastructure.

Successful execution of the production expansion will require sustained investment in facilities, equipment, and workforce over the coming years. The agreements provide a foundation for long-term industrial base stability and position RTX as a key supplier of precision weapons to U.S. and allied forces through the next decade.

Get real time update about this post category directly on your device, subscribe now.