TKMS Seeks Investment Package to Strengthen Canada Submarine Bid

German warship builder TKMS is assembling a multi-sector investment offer to Canada aimed at helping secure a large submarine contract worth more than $12 billion, company leadership said, as competition with South Korea’s Hanwha Ocean intensifies.

The strategy expands beyond the submarines themselves, with talks under way with German and Norwegian firms on commitments in areas such as rare earths, mining, artificial intelligence, and automotive battery production tied to long-term Canadian economic development.

Broad Economic Offer Beyond Naval Hardware

Oliver Burkhard, TKMS chief executive, told Reuters the investment effort is intended as a “broad economic package” designed to align with Canada’s defence procurement priorities and deliver industrial benefits across sectors.

The package concept encompasses more than the submarine build contract alone, which industry sources estimate at over 10 billion euros. The total value of potential investments could rise sharply depending on partner commitments across sectors.

Burkhard said the talks include discussions with companies such as German space startup Isar Aerospace, though he did not disclose all prospective partners.

Competitive Submarine Tender

TKMS’s outreach comes in the context of a competitive procurement process in Ottawa for the Canadian Patrol Submarine Project, which seeks up to 12 new conventional submarines to replace the Royal Canadian Navy’s ageing fleet. Canada has already shortlisted TKMS and South Korea’s Hanwha Ocean in the competition.

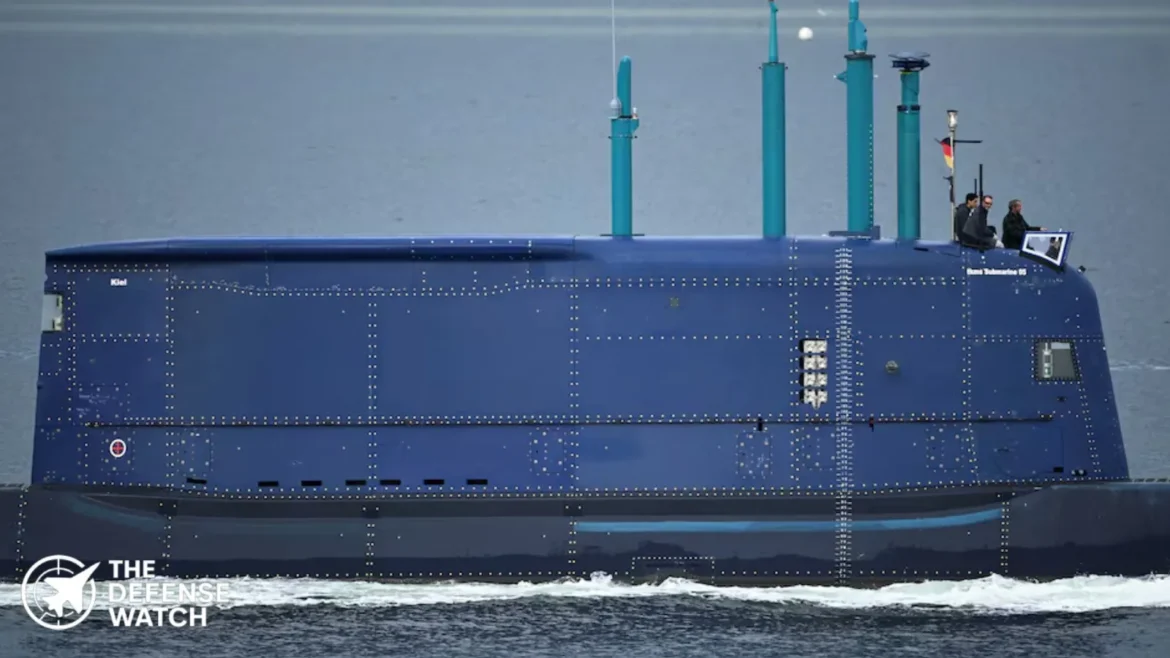

TKMS’s 212CD class is already part of a NATO submarine collaboration with Norway, and the firm is considered the world’s largest builder of non-nuclear submarines, with an estimated 70 percent share of conventional submarines operated by NATO allies.

Canada has articulated a requirement that its defence investments should deliver tangible economic benefits at home. The broader industrial pitch from TKMS responds to this priority by offering a package of offset obligations spanning decades.

Industrial and Strategic Implications

The planned investments cover sectors of strategic interest to Canada, including mining and rare earths, critical to high tech and defence supply chains. Automotive battery production and AI development are also part of the discussions, reflecting Canada’s interest in expanding local industrial capabilities in future-oriented fields.

TKMS anticipates further engagement in Ottawa, with Burkhard planning a march trip to continue discussions with Canadian officials. Canada’s final decision on the submarine contract is expected in 2026.

Industry observers note that linking major defence contracts to wider investment commitments aims to strengthen the overall value proposition for host nations and can be decisive in geopolitical sourcing decisions. The Canadian government’s focus on economic offsets underscores this trend.

Get real time update about this post category directly on your device, subscribe now.