Raytheon Secures Landmark Deal to Expand U.S. Missile Production

RTX’s Raytheon division announced five framework agreements with the Pentagon on February 4, 2026, to significantly increase production capacity for critical precision munitions including Tomahawk cruise missiles, AMRAAM air-to-air missiles, and Standard Missile variants. The up-to-seven-year agreements mark a strategic shift in U.S. defense acquisition policy aimed at rebuilding weapons stockpiles depleted by recent global conflicts.

Under the frameworks, RTX will increase annual Tomahawk production to more than 1,000 units, AMRAAM output to at least 1,900 missiles, and SM-6 production to more than 500 rounds annually. The company will also accelerate production of Standard Missile-3 Block IB and Block IIA interceptors across facilities in Tucson, Arizona, Huntsville, Alabama, and Andover, Massachusetts.

The Raytheon Tomahawk missile production expansion represents a dramatic increase from current output levels. Tomahawk production currently stands at approximately 60 missiles per year for U.S. forces, meaning the new framework will boost annual capacity by more than 1,500 percent.

Rebuilding Depleted Stockpiles After Global Operations

The boost to defense industrial base comes as Washington’s forces tap into stockpiles for various contingencies, most notably operations in the Middle East amid recent conflicts including Israel and Iran’s 12-Day War and operations against the Houthis in Yemen. American forces have employed Tomahawk cruise missiles and Standard Missile variants at unprecedented rates over the past three years.

The agreements follow similar long-term production deals between the Pentagon and major defense contractors under the Trump administration. Lockheed Martin signed deals in January 2026 to quadruple THAAD interceptor production to 400 units annually and boost Patriot PAC-3 output to 2,000 per year under seven-year contracts.

The framework agreements announced are the first between RTX’s Raytheon weapons unit and the Trump administration, which has called on defense contractors to make larger investments in their factories and prioritize speeding up weapons production.

Multi-Year Framework Enables Industry Investment

The collaborative funding approach incorporated in these framework agreements allows RTX to invest confidently in expanding production capacity without shouldering excessive upfront financial risk. The company investments associated with these framework agreements have been contemplated in RTX’s recently announced financial outlook for 2026, with long-term agreements designed to preserve upfront free cash flow.

RTX announced during its recent earnings call that capital investments in facilities and factories would increase from $2.6 billion to $3.1 billion in 2026, reflecting the company’s commitment to expanding defense production capabilities.

Production rates for many of these munitions will grow two to four times their existing levels, according to the company’s announcement. This expansion addresses both immediate U.S. military requirements and growing demand from allied nations seeking American-made precision weapons.

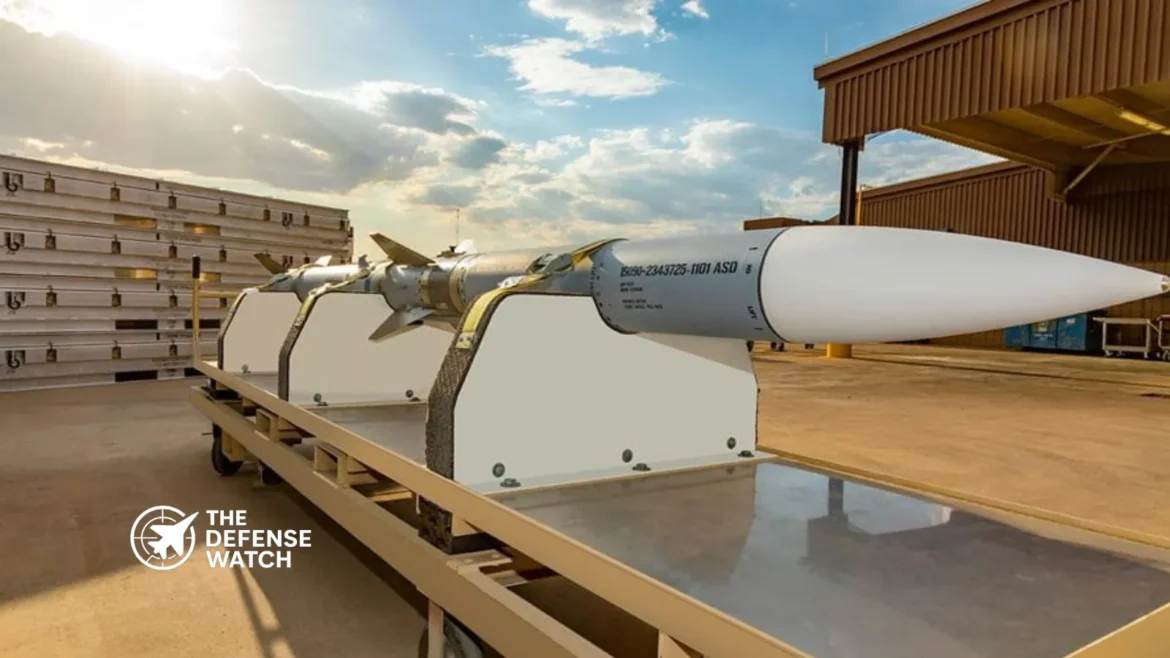

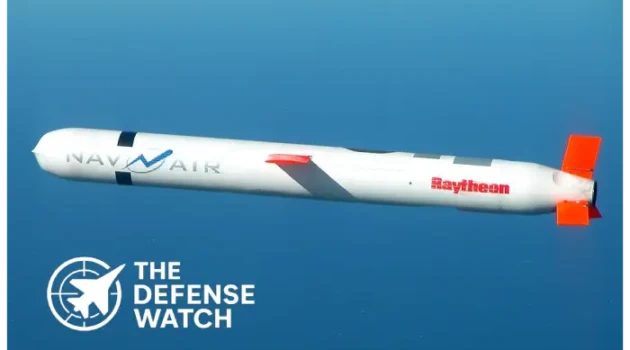

Tomahawk: Proven Strike Capability With Global Demand

The Tomahawk is a precision weapon launched from ships and submarines that can strike targets from 1,000 miles away, even in heavily defended airspace. Its combat record speaks to its reliability and effectiveness across multiple conflict environments.

U.S. and allied militaries have flight tested the Tomahawk over 550 times and used it in operational environments more than 2,300 times. The cruise missile routinely serves as the first strike option for U.S. forces targeting hostile assets worldwide, offering commanders a standoff precision strike capability that minimizes risk to aircraft and personnel.

International demand for Tomahawk missiles continues to grow. In 2024, Tokyo ordered 400 Tomahawks to equip its destroyers with land attack capabilities, marking a significant enhancement to Japan’s offensive strike options amid rising tensions in the Indo-Pacific region.

The framework agreements cover both Land Attack and Maritime Strike variants of Tomahawk, providing flexibility for anti-ship missions as well as traditional land-based target engagement.

AMRAAM Production Surge Addresses Air Defense Needs

AIM-120 Advanced Medium-Range Air-to-Air Missiles will increase to 1,900 missiles annually, likely restoring and strengthening stocks attrited by air defense actions in the Middle East and missiles sent in defense of Ukraine.

Since 2024, Raytheon has been producing the fifth-generation AMRAAM, featuring advanced guidance, software-defined capabilities and enhanced electronic protection for highly contested combat environments. The weapon serves dual roles as both an air-to-air missile for fighter aircraft and as the primary interceptor for the National Advanced Surface-to-Air Missile System (NASAMS).

With more than 40 allied nations operating AMRAAM-equipped systems, increased production supports both U.S. forces and partner nations requiring modern air defense capabilities. The missile has demonstrated proven performance through more than 6,000 test shots and 13 confirmed air-to-air combat victories.

Standard Missile Family Expansion

The framework agreements also encompass significant production increases for the Standard Missile family, which provides layered defense against aircraft, cruise missiles, and ballistic threats.

Standard Missile-6 (SM-6) offers unique multi-mission capabilities. SM-6 is the only missile that supports anti-air warfare, anti-surface warfare and sea-based terminal ballistic missile defense in one solution, providing naval commanders with maximum flexibility in magazine loading and tactical employment.

Standard Missile-3 (SM-3) variants focus on ballistic missile defense. SM-3 IB is a combat proven interceptor uniquely designed for exo-atmospheric intercept of short- to intermediate-range ballistic missiles with hypersonic hit-to-kill accuracy, and can be launched from both ships and land-based sites.

The SM-3 Block IB saw its combat debut in April 2024, successfully intercepting Iranian ballistic missiles targeting Israel. This operational validation underscores the weapon’s critical role in regional missile defense architectures.

Strategic Implications for Defense Industrial Base

The Raytheon framework agreements represent a fundamental shift in Pentagon acquisition strategy. Rather than ordering weapons on a year-by-year basis through traditional contracting mechanisms, these multi-year frameworks provide industry with demand certainty that justifies major capital investments in production infrastructure.

This approach addresses longstanding concerns about U.S. defense industrial capacity to sustain high-intensity warfare. Deals signed by Lockheed Martin in recent months indicate a shift in defense acquisition strategy aimed at rebuilding America’s industrial capacity to sustain high-intensity warfare.

Geographic diversification of production across multiple states also enhances supply chain resilience. Manufacturing distributed among Tucson, Huntsville, and Andover reduces vulnerability to disruption from natural disasters, accidents, or deliberate targeting.

Indo-Pacific Focus Drives Munitions Demand

Munitions deemed critical for countering China in the Indo-Pacific such as Tomahawk cruise missiles and the fleet’s ubiquitous Standard Missile series have been used at scale globally over the last three years. Pentagon planning scenarios for potential conflict in the Western Pacific project extraordinary consumption rates for precision-guided munitions.

U.S. Navy leadership has emphasized the importance of these weapons for future force structures. The Surface Navy Association annual symposium in January 2026 saw service leaders highlight the role SM-6 and Tomahawk missiles would have across the upcoming Golden Fleet, specifically aboard unmanned surface vessels via modular missile payloads.

Expanded production capacity enables the Navy to distribute strike and defensive firepower across a larger number of platforms, including lower-cost unmanned systems that can operate in high-risk environments where crewed vessels would face unacceptable exposure.

Collaborative Supply Chain Expansion

RTX has partnered with multiple defense contractors to address potential bottlenecks in missile production, particularly solid rocket motors which serve as critical components across multiple weapon systems. The company has collaborated with defense contractors such as Anduril, Northrop Grumman, Avio USA and Nammo to increase the supply of solid rocket motors.

This collaborative approach recognizes that expanding final assembly capacity alone is insufficient if subcomponent suppliers cannot scale accordingly. By investing across the entire supply chain, the defense industrial base can achieve sustainable, long-term production rate increases.

Looking Ahead

The Raytheon framework agreements establish a foundation for sustained U.S. missile production through 2033. With annual Tomahawk output projected to exceed 1,000 units, AMRAAM production reaching 1,900 missiles, and Standard Missile variants seeing similar expansion, American forces will possess significantly deeper magazines for both offensive strike and defensive operations.

These production increases also strengthen allied capabilities, as partner nations increasingly purchase U.S.-manufactured precision weapons to modernize their arsenals. The combination of domestic stockpile reconstitution and expanded foreign military sales supports both American security interests and the defense industrial base.

RTX’s capital investment commitments, paired with Pentagon demand certainty through multi-year frameworks, position the company to deliver these critical munitions at unprecedented scale. As global security challenges intensify, particularly in the Indo-Pacific, expanded missile production capacity provides military planners with essential tools for deterrence and, if necessary, sustained combat operations.

Get real time update about this post category directly on your device, subscribe now.