Table of Contents

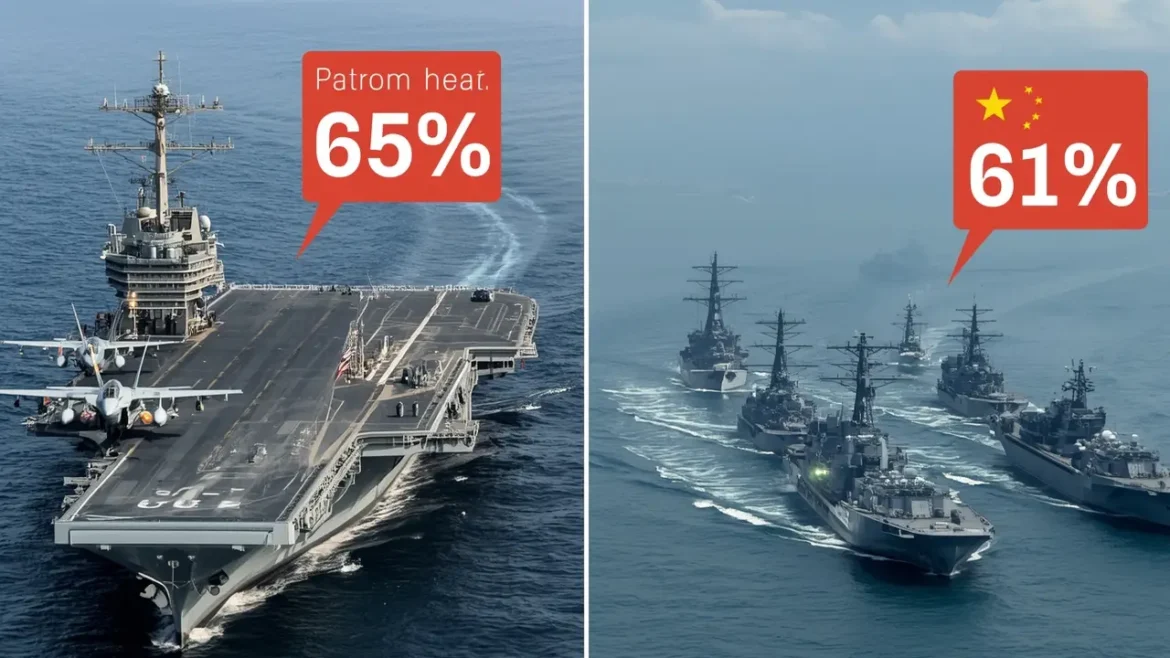

As competition between the United States and China intensifies, the defense spending and military capabilities of both powers have come under close scrutiny. The numbers reveal a clear gap in funding, but when it comes to capabilities, modernization, and strategic positioning, the picture is more nuanced. This article examines how the United States and the People’s Republic of China stack up in terms of defense budgets and military assets — and what it means for global strategy.

Defense Spending: The Numbers

US Military Spending

In 2024, the United States’ military expenditure reached approximately US$997 billion, according to the Stockholm International Peace Research Institute (SIPRI). That figure represented about 37 % of global military spending, putting the U.S. far ahead of any other country.

China’s Reported Budget

China’s official military budget for 2024 was estimated at around US$314 billion. On the surface, this places China at roughly one-third of U.S. spending.

Adjusted Estimates and the “Hidden” Gap

Yet analysts caution that official figures do not necessarily capture the full picture. For China, off-budget spending, currency conversion (to reflect purchasing power) and other hidden expenditures may raise the real number. One study estimates China’s full defense outlay could be US$471 billion in 2024 — about 36 % of U.S. levels. Others argue China’s spending might still be significantly less in terms of comparable capability.

Spending Trends

The global context is also telling: world military expenditure rose to US$2.718 trillion in 2024, marking the largest year-on-year jump since the Cold War’s end. China increased its spending by about 7 % in 2024. U.S. spending rose by about 5.7 %.

Summary Table

| CountryEstimated 2024 Budget (US$ billion)% of Global Military Spending* | ||

|---|---|---|

| United States | ~ 997 | ~ 37 % |

| China | ~ 314 (official) | ~ 12 % |

| China (adjusted estimate) | ~ 471 | ~ ? (≈ 36 % of U.S.) |

Military Capabilities Beyond the Numbers

Budget size is only one dimension; the quantity, quality and technological sophistication of capabilities matter immensely.

Force Structure and Platforms

According to data from Global Firepower for 2025, the U.S. enjoys advantages in many categories: aircraft, transport assets, trainer fleets, and total tonnage of naval vessels. However, China has been rapidly expanding specific force types — especially naval shipbuilding and missile forces.

In fact, top U.S. officials cite China’s pace of expansion as a concern. For example, the head of U.S. Indo-Pacific Command recently told the Senate the pace at which China is building naval combatants is roughly three times that of the U.S.

Modernization and Technological Focus

China is focusing its resources on modernization: carrier aviation, stealth fighters, hypersonic missiles, unmanned systems, and space/cyber capabilities. For instance, in its unclassified annual report, the U.S. Department of Defense lists China’s rapid military-technological development as one of the defining strategic challenges.

While the U.S. still holds the lead in many advanced domains – such as global power projection, nuclear triad readiness, logistics networks and long-range precision strike – China is closing the gap in regional context and in niche technologies.

Strategic Reach and Regional Focus

The U.S. retains a truly global force posture, with bases and allies stretching across every major region. China, by contrast, concentrates on the Indo-Pacific theatre, particularly the South China Sea, Taiwan Strait and surrounding maritime approaches.

This regional focus gives China certain advantages: shorter logistics, concentrated theatre of operations and rapidly proliferating platforms optimized for regional conflict. The U.S., while global, must balance far-flung commitments and logistics burdens.

Strategic Implications

Budget Gap ≠ Automatic Dominance

Despite the sizable budget gap favoring the U.S., that does not guarantee automatic dominance. Capability depends on how money is spent, technological breakthroughs, logistics, training, readiness and doctrinal alignment. Some analysts argue that China’s effective capability may be only 40-50 % of U.S. capability in some domains despite higher spending growth.

Escalating Regional Competition

In the Indo-Pacific, where China’s strategic objectives are defined (Taiwan, South China Sea, maritime approaches), its growing focus on naval assets, missiles and integrated air-sea-space operations directly challenges U.S. and allied force postures. The U.S. must respond not only with spending but with force structure adaptation, alliance reinforcement and technology accelerations.

Modernisation Race & Technological Leverage

Both countries are racing to embed advanced technologies – artificial intelligence, unmanned systems, cyber-space convergence, hypersonics. The side that masters integration and operational concept may achieve disproportionate advantage even if budgets are close.

Fiscal & Economic Constraints

A large defense budget is sustainable only if the economic base supports it. The U.S. faces growing fiscal constraints, rising debt and competing domestic priorities (education, infrastructure, health). China, while still growing, faces slower growth, debt pressures and a shift in economic structure. Maximizing force effectiveness will become as important as raw spending.

Outlook & What to Watch

- Spending trajectory: Will China continue consistent ~7 % + annual increases, and how will the U.S. budget evolve given domestic pressures?

- Force mix changes: China’s increasing naval ship count, missile inventory and asymmetric systems vs. U.S. investment in unmanned/autonomous systems.

- Alliances and forward posture: U.S. reinforcement through allies (Japan, Australia, India) vs. China’s regional partnerships and influence campaigns.

- Technological breakthroughs: Hypersonics, AI-enabled decision-making, quantum communications, space/ASAT capabilities could shift the balance.

- Operational doctrine and training: Numbers matter less than readiness, integration and real-world experience. The U.S.’ global presence gives it strength; China’s regional focus demands high readiness for that theatre.

Analysis & Context

Budget figures may dominate headlines, but the qualitative side of capability development is equally critical. The U.S. remains ahead in most measurable domains, but the gap is narrowing in certain regional and mission-specific contexts. China’s strategy of focusing on the Indo-Pacific, leveraging cost advantages, and pursuing fast naval expansion mean Washington cannot rely purely on historical dominance.

Furthermore, the geopolitical environment increasingly rewards agility, technology and adaptability rather than sheer size. For example, a smaller force well-equipped with integrated systems might offset a numerically larger but less agile opponent. It is in that margin — the “how” not just the “how much” — that much of the future contest will be waged.

FAQs

In 2024, the United States spent about US$997 billion on defense, while China’s official figure was around US$314 billion. However, adjusted estimates place China at a higher amount due to off-budget items.

No — while budget size matters, factors like training, logistics, technological integration, readiness, doctrine and strategic focus play equally important roles. Analysts caution that China’s capability remains behind the U.S. despite rapid spending growth.

China is prioritizing naval expansion, carrier aviation, stealth fighters, integrated air-sea-space systems, missile forces (including hypersonic), cyber and space capabilities.

While the U.S. still commands the largest defense budget globally, fiscal constraints, rising debt servicing and domestic demands may limit growth. The U.S. must balance global commitments with sustainable budgets.

The growing China-U.S. military spending gap and capability race increase strategic risks — especially in the Indo-Pacific region. It underscores the need for alliances, forward posture, technological edge and adaptable force structure.

Get real time update about this post category directly on your device, subscribe now.

1 comment

[…] the proposal, euro zone members could tap precautionary credit lines to ease budget stress tied to military spending. These lines are usually offered to countries with strong finances as a form of insurance against […]