US Expands Air Defence and Cruise Missile Production in Major Pentagon Deal

The US is significantly increasing missile production to strengthen air defence and long-range strike stocks under a series of new Pentagon agreements. The expansion covers key systems including Tomahawk cruise missiles and air defence interceptors as the Defense Department seeks to rebuild inventories and ensure industrial capacity, Pentagon contractors say.

Pentagon Framework Agreements With Industry

On February 4, Raytheon Technologies, through its Raytheon business unit, signed five long-term framework agreements with the US Department of Defense intended to grow manufacturing capacity for critical missile systems. These deals could last up to seven years and are aimed at accelerating deliveries to US forces and allies while stabilising production planning.

Under the agreements Raytheon will expand output of multiple missile families, including:

- Tomahawk Land Attack and Maritime Strike cruise missiles, with production rising to more than 1,000 units per year.

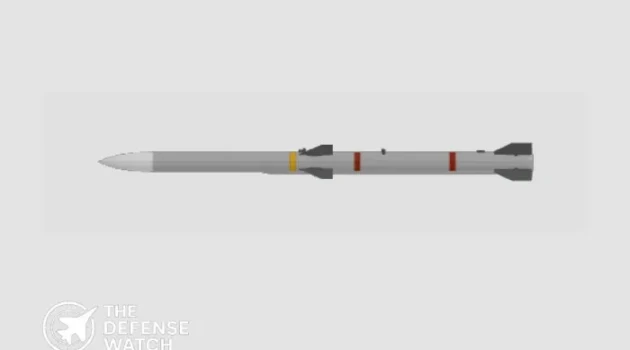

- AIM-120 Advanced Medium-Range Air-to-Air Missiles (AMRAAM) to at least 1,900 per year.

- Standard Missile-6 (SM-6) interceptors to more than 500 annually.

- Accelerated production of SM-3 Block IB and Block IIA ballistic missile interceptors.

These increases represent a multiple-fold rise over current production rates for several systems, reflecting demand from global operations and efforts to replenish inventories drawn down by recent contingency operations.

Strategic Context and Rationale

The Pentagon’s move comes amid sustained use of munitions in operations across regions including the Middle East and support for partner forces. The Tomahawk and AMRAAM have played prominent roles in long-range strike and air defence missions, and demand has grown with broader allied reliance on US-made systems.

The framework agreements are tied to the Defense Department’s Acquisition Transformation Strategy, a broader effort to secure long-term stable production and improve government-industry cooperation. Officials have stated that predictable demand and multi-year funding help defence firms invest in facilities, workforce, and technology upgrades.

Production centres for these efforts are located at major Raytheon facilities in Arizona, Alabama and Massachusetts.

Broader Production and Industrial Moves

Separate from the Raytheon agreements, other defence contractors are also ramping up production of air defence systems. Lockheed Martin has agreements to increase PAC-3 Missile Segment Enhancement (MSE) production under Pentagon contracts, with annual output targets rising in the coming years to meet growing demand.

Lockheed Martin is also expanding Terminal High Altitude Area Defense (THAAD) interceptor manufacturing under similar framework agreements with the US Department of War, aiming to grow annual output significantly.

These combined industrial actions underscore a broader Pentagon focus on rebuilding and strengthening the US defence industrial base for sustained high-intensity operations and allied support.

What It Means for US and Allied Defence

The expanded production plans aim to improve readiness for air and missile threats while ensuring long-term supply chain stability. Systems like the Tomahawk provide deep strike capability, while AMRAAM and Standard missiles support air defence and anti-air warfare across multiple platforms. PAC-3 and THAAD interceptors remain core to layered defence architectures against ballistic and cruise threats.

By investing in industrial capacity now, the US and its allies can better hedge against future operational demand and geopolitical pressures. Continued production increases will likely shape force posture and inventory levels through the end of the decade.

Get real time update about this post category directly on your device, subscribe now.